- Yes

- No

0 voters

Introduction

ELIP#: 1

Title: Streamlining RTP Process to Enable Tokenization of Diverse Real-World Assets on ELYSIA Protocol

Network: all

Author: Jong

Helper: Deok

Status: Discussion

Date Created: 2023-04-12

Date Updated: -

Short Summary

Streamlining RTP Process to Enable Tokenization of Diverse Real-World Assets on ELYSIA Protocol.

Paragraph Summary

ELYFI, one of the key protocol in the ELYSIA ecosystem, is working on a project to bring a variety of real-world assets to the on-chain market, and to support this, ELYSIA proposes to simplify governance procedures for RWA tokens obtained from pools.

ELYFI is planning to launch a pool to explore new collateral options and improve the scalability of the protocol. The collaterals that will be used in the pool is Korea’s e-commerce receivables. Since Korea’s e-commerce accounts receivable have a short maturity of about 7 days on average, ELYSIA needs to optimize the governance procedure. To streamline the process, we are proposing a more simplified governance procedure than what is currently in place, which would involve replacing the existing governance procedures with one-hour snapshots and skipping the forum.

Background Information

Background 1: Necessity for various real-world assets(RWAs)

To keep up with the dynamic market conditions, ELYSIA expand its business and ecosystem through diversifying its range of RWAs. In order to facilitate this development, it is crucial to have a versatile environment that can accommodate various types of RWAs.

Advantages of diversification of RWAs

ELYSIA ecosystem can grow and become more resilient by diversifying its sources of revenue and attracting new customers with tokenizing a range of RWAs. By expanding beyond its current focus on real estate, the ELYSIA protocol can generate new revenue streams and appeal to a broader customer base. This would enable ELYSIA to increase its market share and strengthen its position in the market.

Moreover, relying solely on real estate assets can expose the ELYSIA ecosystem to market volatility and uncertainty. To mitigate this risk and enhance stability, ELYSIA can reduce its reliance on a single asset class by diversifying its RWAs. This would help protect the ELYSIA ecosystem against the impact of market fluctuations in any particular asset class.

Background 2: Entry barriers to current governance procedures

The current governance procedures in place at ELYSIA can create entry barriers for some ****borrowers. Current governance procedures are specifically one day in the forum, 24 hours of voting in snapshots, and a minimum of 48 hours of Safenap procedures (Note: Background 1). The loan-on-boarding process mentioned above will take more than 5 working days.

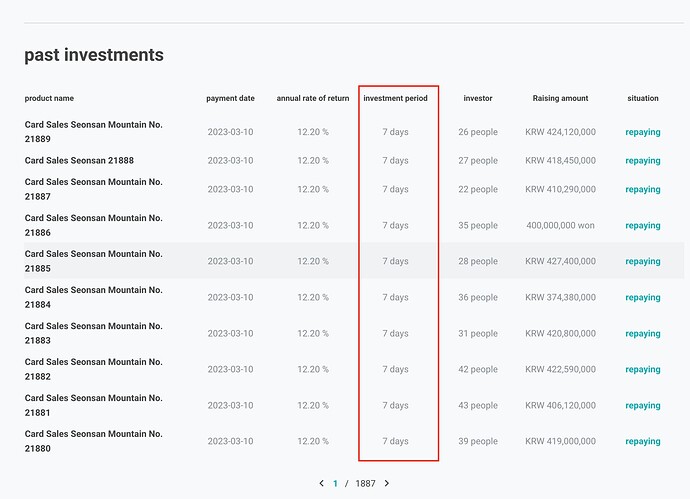

These fixed governance procedures can limit the acceptance of various RWAs as ELYFI collateral. Although bonds with an average maturity of over six months have been offered in the past, the new pool product will use short-term e-commerce accounts receivables as collateral. In the attached image below, it can be observed that the products provided by companies dealing with e-commerce receivables in Korea have relatively short maturities.

On average, the maturities of these bonds range from seven days, with some lasting as short as three days. This indicates that a more agile governance approach is needed for full products backed by short-term e-commerce sales bonds as collateral.

Source: 90days.kr

Background 3: Tokenization process in ELYSIA - RTP Process

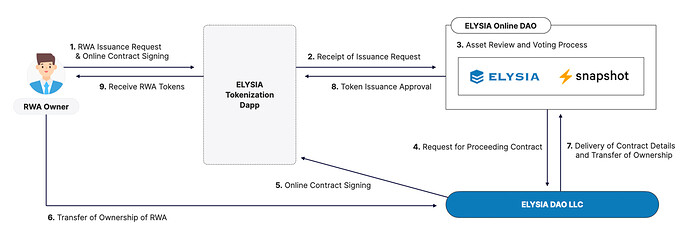

Source: ELYSIA Whitepaper v2.1

To create tokens in ELYSIA, a tokenization proposal submission process called RTP (RWA Tokenization Proposal) must be completed. This process involves submitting an RWA tokenization proposal, which proceeds through the forum to the final decision-making process via snapshot voting.

RWA owners can enter the ELYSIA Forum and post information about their assets in an RTP template. Forum members will then review the information, and snapshot voting will take place to determine whether the proposal is accepted or not. If the proposal is passed by voters, the RWA token can be used in crypto finance such as ELYFI.

For reference, Snapshot is a vote that takes place outside the blockchain, so it is necessary to reflect it on the on-chain. We apply the Safesnap Plugin function to snapshots to reflect voting results on the on-chain in a decentralized way. It is currently set to take at least 48 hours for the results of the vote to be reflected on-chain via Safesnap.

Proposal details

Design tokenization forms for diverse RWAs

I propose to diversify the real-world assets on the ELYSIA platform by introducing a new tokenization form for Korea ecommerce accounts receivable. This will create a new asset class and provide more opportunities for users, increasing the overall value of the ecosystem.

Simplifying Governance Procedures Reflecting RWA Characteristics

Adjust governance period

Under the current ELYSIA governance structure, short-maturity RWAs such as e-commerce accounts receivables cannot be used because it takes a lot of time to tokenize RWAs. Therefore, ELYSIA needs to flexibly adjust the governance period depending on RWAs. In this pool, we suggest to reduce the snapshot process to one hour.

RTP forum procedure omitted

In addition, this pool will be made of revolving structure because it is secured by bonds with short maturity. For smooth revolving, we’d like to skip the forum procedure and replace it with a snapshot.

Reference

- Safesnap explanation: https://docs.snapshot.org/plugins/safesnap-reality

- Korea e-commerce A/R examples: 90days.kr